You’ve heard it a thousand times before. You’ve probably said it a thousand times before. “I’m on a budget,” you say cheekily before ordering the $5 PBR and shot combo at your local dive. And while that’s all well and good, the less sexy truth is that being on a budget is a bit more complex than just ordering the cheapest liquor at the bar. But trust us, starting to seriously think about budgeting now is something that future you will be very, very grateful for.

Simple steps in making a budget

If you break it down, a budget is actually a pretty simple equation. You look at what comes in versus what comes out, and want to ensure that what goes out is less than what comes in. But in order to achieve that, you’re going to have to do some financial housekeeping.

Understanding your financial habits is key to knowing why you have a certain amount coming out each month, and will help you eventually reduce that amount so you’re left with more in your bank account at the end of the month. Sound good/super scary and like lots of work? Awesome, here’s how to get started:

1. Figure out how much you make per month

This is the first step, the “what comes in” part. Gather your paychecks and calculate the net income (the amount you have left after taxes) to see how much money you’re taking home per month. If you’re a freelancer, that part’s a bit trickier. Collect all your invoices from the past year and add them up to see how much you’ve been making on average per month. If you don’t expect your contracts to change too wildly, go off of that monthly estimate. You’ll also have to factor in any taxes you might owe at the end of the tax year. If you have any dividend income you receive from investments, factor those in as well.

2. Figure out how much you’re spending on necessities per month

Now comes the “what comes out” part, which is decidedly less fun. Make a list of all of your monthly bills: rent, any subscription services like Netflix or Spotify, water, electricity, gas, mortgage payments, car payments, your phone bill, health insurance, gym membership, etc. These are also known as “fixed” expenses, or expenses that you have to pay every month and that usually stay about the same.

3. Figure out your variable expenses

These are expenses that aren’t necessarily fixed and aren’t necessary for keeping a roof over your head and the lights on. These are also known as “fun” expenses: money you spend on clothes, dinners out, happy hour drinks, trips, theatre and movie visits, grocery trip visits, and so forth. Depending on your lifestyle, this one might hurt a little to confront.

4. Add up all of fixed and variable expenses, and compare to income

Here’s where the simple math comes in. If your expenses are higher than your income (or you’re barely breaking even), it’s time to budget!

How to save money when you’re on a budget

Reduce your variable expenses

The best and most obvious place to start will be with your variable expenses. Some tips on reducing your “fun” costs (we know, sorry):

- Cook at home instead of eating out. This is healthier for both your wallet and your body! Instead of getting some greasy takeaway on your way home from work or buying a $16 salad for lunch, cook a big batch of something delicious so you’ll always have a meal ready instead of having to buy it.

- Ditch the expensive caramel-soy-mocha-whatever-lattés, get yourself a nice thermos, and make your own damn coffee at home. You’ll save so much money in the long run

- Buy your groceries at a cheaper supermarket, or go to the farmer’s market, where produce will be cheaper, fresher, and in season. There’s no time like the present to ditch that Whole Foods habit.

- Find ways to hang out with friends that don’t involve buying rounds at the bar. Host a potluck, have friends over for movie night, go to the park, explore a new neighborhood… it’ll get you out of your same Friday-Sunday routine, and you might just find a new favourite activity that won’t leave you with a hangover the next morning.

- Shop the sales. Do you really need that $50 graphic tee, or can you bear to wait until next month, when it’ll be on sale for $15? Or maybe you’ll find something way better for $12 then! Sales are exciting that like.

Cut your subscriptions (or at least some of them)

Now it’s time to look at those fixed expenses. The easiest place to start is with your subscriptions. Do you really need Netflix, Hulu, HBO, Showtime, and whatever else there is out there? Could you maybe cut it down to one and then get access to the other ones by using your ex-girlfriend’s aunt’s password, like everyone else does? Same with Spotify, Tidal, Apple Music, etc. Just pick one and call it a day. Then also take a hard look at your gym membership. When’s the last time you actually went to the gym? Sometime in 2016? Cancel that, now. Use the money you saved to buy yourself some weights to use at home instead; even if you don’t use them, it’ll still be better than sending a monthly donation to Crunch.

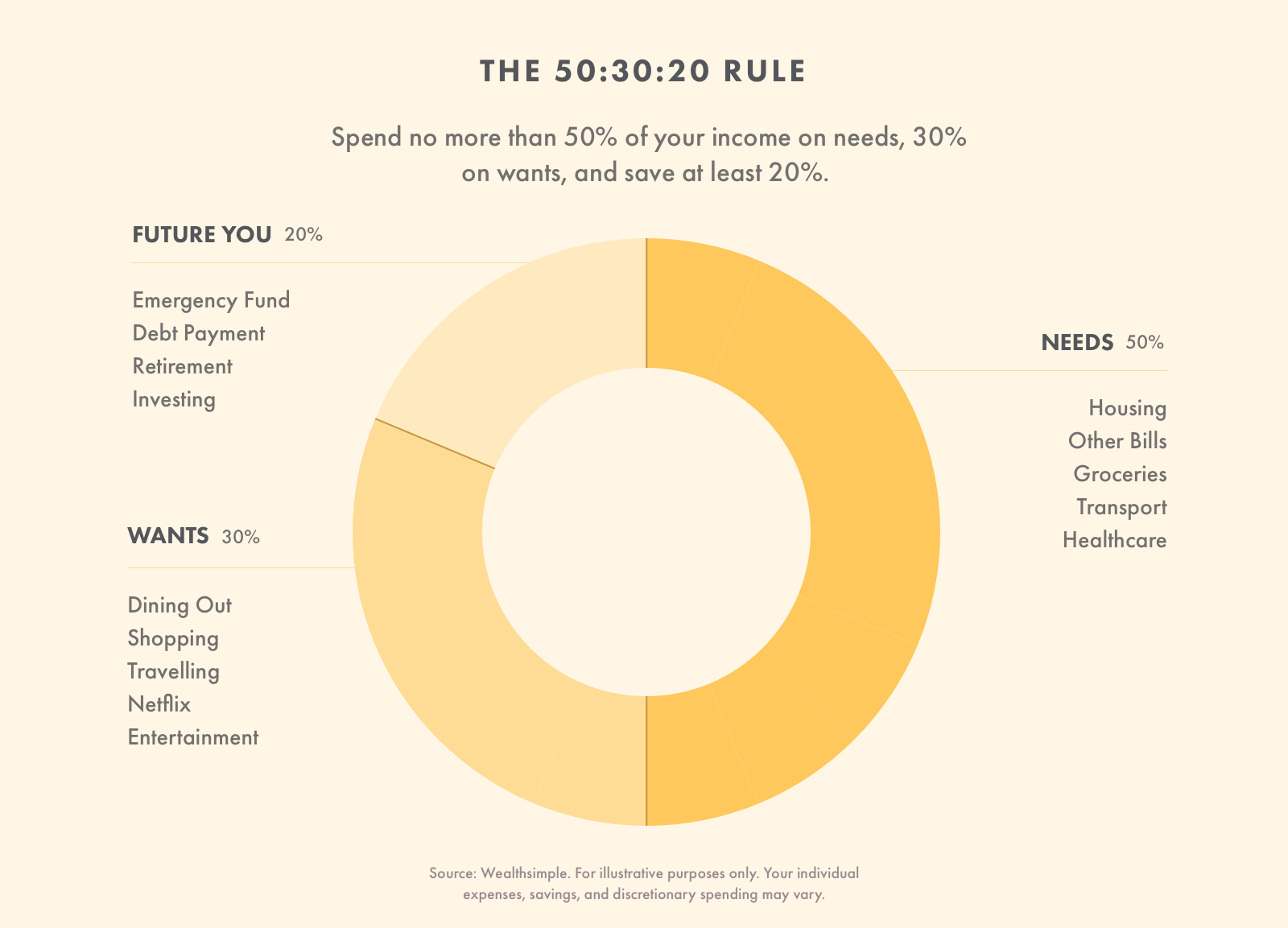

Consider the 50/30/20 rule

Think of this as more of a guideline than a rule. About 50% of your income should be spent on non-negotiable necessities like rent, utilities, car payments, mortgages, and so forth. Basically, most of your fixed expenses. 30% of your income goes to your variable expenses, where you have the most flexibility for saving and cutting costs. The remaining 20% should be for ensuring your financial health: that means paying off high-interest debt, adding to your savings, and investing for the future. The percentages will vary depending on your income, extra financial needs, and debt situation, but it’s a good benchmark.

Figure out a savings plan that works for you

Now that you’ve cut down on some less-than-necessary expenses, it’s time to think about what to do with that extra money. The first order of business will be to find a savings account that has relatively high yields where you can park some of your money. If you haven’t had the chance to build up any savings yet, this is an important first step. Although your money won’t be yielding any high returns like they would in investments, savings will be crucial for helping you tide over rough periods, work toward a short-term goal (five years or less) like a house, a vacation, or a wedding. Savings will also help you build the financial foundation for you to start confidently investing. Which brings us to the next point…

Start investing

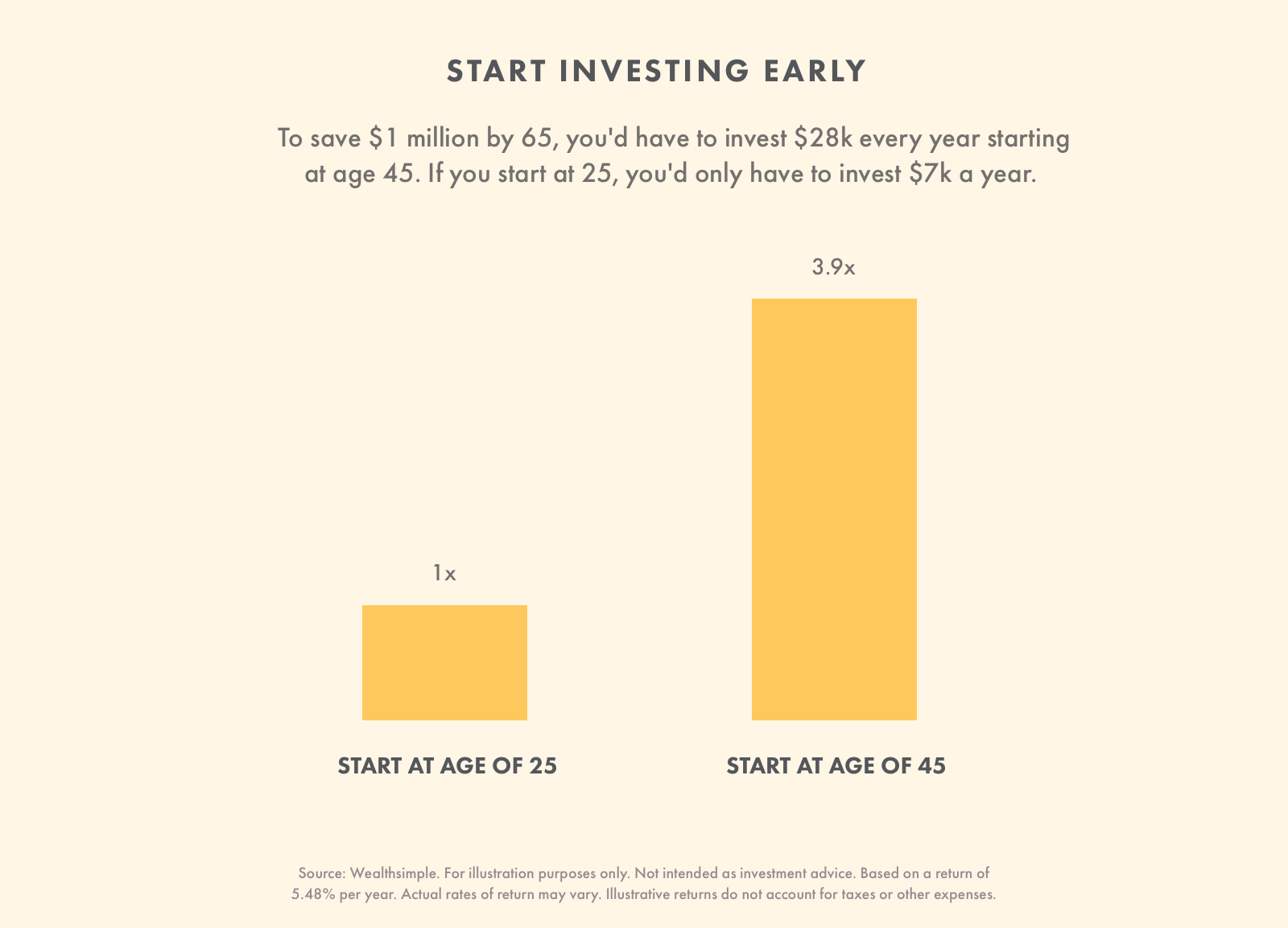

Once you have enough savings to cover two to three months’ worth of living expenses, it’s time to start using some of that “20%” section of your income for investing. This way, your money will work harder than it would be just sitting in a savings account, and you’ll also be benefiting from the magic of compound interest as your money accumulates interest over time. The key word here is “time.” The money that you invest is not meant to be easily accessible, unlike your savings. The money that you invest should go towards a long-term saving strategy, like retirement or your yet-to-be-born child’s college fund. Look for investment accounts that have low fees and low barriers of entry to get started as soon as possible.

Another great option when trying to invest on a budget? Microinvesting. What that means is that instead of investing large sums, you’re literally investing spare change—often automatically—by linking your debit and credit card to an account that rounds up purchases and invests the change. That way, you’re investing money you won’t even miss, and can accumulate up to several hundred dollars in a year that way, just by going about your day. It doesn’t get easier than that.

How to stick to a budget

Now that you’ve set up the budget, you’re facing the hard part: actually sticking to it. The key to sticking to a budget is the same as sticking to a diet: it’s only going to work if it’s sustainable for your lifestyle. That means that if you love going out to dinner or can’t live without your Netflix, Spotify, and co, it’s unrealistic to completely cut these things out of your life and expect you to stick with it. So the most important part of creating a sustainable budget is making sure it actually works for your life. That being said, here are some tips on how to make the whole thing less painful all around:

Use cash

Using cash for your daily expenses will help you keep track of how much money you’re spending way easier than when you’re just mindlessly swiping a piece of plastic. Take out a certain amount of cash once a week or so, and once that amount is gone, you’re done. It’ll also make you think about your purchases much more carefully. After all, if you only have $50 left in your wallet, do you reaaaally need to buy another satin embroidered bomber jacket for $45?

Choose one subscription, and delete the rest

As we said before, just get that Hulu password from your former coworker’s second cousin’s boyfriend like everyone else.

Set up automatic deposits

By ensuring that a set amount is automatically deposited from your checking account to your savings and to your investment accounts each month, you don’t even have to remember to set aside the money. A monthly recurring deposit ensures that your savings can build and takes the human error out of the equation.

Curtis Pope, a Portfolio Manager at Wealthsimple explains that sticking to your budget and automating your savings is the key to success.

For successful clients, automatic saving is probably the most powerful part of their financial strategy.

Curtis recommends that people closely monitor their cash flow to ensure that net income is higher than their expenses. Then you should save any additional left over money. A monthly recurring deposit ensures that your savings can build and takes the human error out of the equation. It also means you can accidentally spend your savings on Coachella tickets.

Start meal planning

Instead of going to the grocery store and just grabbing whatever strikes your fancy and ending up with 10 tubs of Nutella and one avocado, actually write down a list before going. Even better, consider what you want to cook throughout the week so you have a rough idea of the meals you’ll be making, and can plan accordingly. You’ll be way less tempted to eat out once you have all the ingredients to make delicious, nutritious meals right at home.

Forget you have a credit card

A credit card is a classic budget buster. When you get swipe-happy, it can be hard to remember that you’re still spending money… but you’ll remember all the more painfully when you get the credit card statement the next month and realize you blew your budget at Señor Frogs. So don’t spend money you don’t have, and just leave the credit card at home.

Revisit your budget every month

Look, things happen. Unexpected expenses pop up, that dress you saw in the shop the other day is haunting your dreams, your best friend decided to get married and wants to have a bachelorette weekend in Cancún like, yesterday. Revisiting your budget every month and making adjustments to new developments, new income sources, and new expenses means that your budget stays manageable and compatible with your life. Ultimately, that’s what will move you towards a successful budget.

*

If you’re keen to get started on your own budgeting journey,

saving and investing are crucial components of that.

CLICK HERE TO GET STARTED.

*

This article was originally written for and published by Wealthsimple.com on January 14th, 2019 and has been republished here with their permission.

*

If you like what we’re doing, follow us on:

INSTAGRAM, TWITTER, and FACEBOOK

From Our Comments