OMG it’s Financial Literacy Month, friends! And never have we been more excited about it than we are now because (a) we pretty much just found out that it’s a thing, and (b) because we’ve dedicated the past year to empowering ourselves by studying the rules of the game of finance and now we are P U M P E D to share our findings with all of you so that you too can reap the benefits of getting your $hit together.

What we’ve discovered over the past several months is that there are a few key things you can do to get your financial health in check that literally take a couple minutes and can all be completed online from the comfort of your couch in the span of ONE DAY. Because a lot of this stuff relies on interest compounding over time (a good thing for savings… a bad thing for debt), the best day to get started on all of this is (you guessed it) TODAY.

So, what can you do TODAY, in a matter of minutes, to get your $hit together? You can:

FIND OUT YOUR CREDIT SCORE

A credit score is a number between 300 and 900 that reflects how much credit you’ve had and for how long, and how well you’ve done paying it off. If the prospect of finding out your credit score is bringing up some serious fear, anxiety, or insecurity, just remind yourself that this is simply the first (and arguably most important) step of finding out where you are now so you can navigate toward where you want to go from here. Now take a deep breath and head on over to either transunion.com (U.S.) or equifax.ca (Canada), give them the cash equivalent of three oat milk lattes, and in return they will allow you a peek at your score.

Once you get it back, here’s how to decode it:

The more likely you are to default on a loan, the closer to 300 your score will be. This means that if you do get a loan, you will have to pay a higher interest rate to make up for your riskiness.

The less likely you are to default on a loan, the closer to 900 your score will be. In that case, if you were to get a loan, you would be rewarded for your trustworthiness with a lower interest rate.

The higher the score, the more power you’ll have in situations where you need to play hardball with the bank—like, for example, when you’re buying a home or opening a business. You would be surprised how quickly interest rates can change and monthly service charges are waived when you let them know you know your worth. Your goal should be to get your score up to a cool 700.

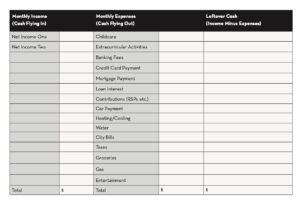

START A BUDGET SPREADSHEET

(AND START FILLING IT IN WITH THE NUMBERS YOU KNOW OFF THE TOP OF YOUR HEAD)

Creating a basic budget is clutch because in order to get your $hit together, you need to understand what your money actually looks like on paper, familiarize yourself with your current financial habits, and – if you’re a parent – plan for a future full of very expensive dependents. It’s not as daunting as it sounds, and we promise you will feel a thousand times better once everything has been accounted for and organized.

We prefer throwing everything into Google Sheets (available to anyone with a Gmail account) for optimal organizational and updating capabilities, but here’s a starter sheet you can use as inspo for your own, right out of the pages of our new book!

DECIDE HOW YOU’LL GET OUT OF HIGH INTEREST DEBT

(THEN SET UP AUTOMATIC PAYMENTS)

There are two ways to get out of debt: (a) reduce those debts, or (b) increase your income.

If you want to give the first option a go, consider employing one of the following two debt-busting strategies:

STRATEGY 1: The Debt Snowball

Ideal for people who need some small wins right off the bat to motivate them to keep going

- Make a list of all debts owing, including the full amount and interest rate.

- Prioritize them in order of lowest balance to highest balance.

- Identify and cut out some unnecessary expenses from your life. (That budget you made earlier will be helpful in this activity.)

- Take the money you’ve scraped off from limiting unnecessary expenses, and start putting it toward your lowest-balance debt first. Keep paying the minimums on all other sources of debt. Use as many automated tools as possible in doing so (seriously, auto-payments are your friend—set them up online or with a teller if you must).

- Once you’ve paid off the first block of debt, take the money you were putting toward it and shift it to the next one.

STRATEGY 2: The Debt Avalanche

Ideal for people who are less concerned with small wins and more interested in getting debt-free ASAP

- Make a list of all debts owing, including the full amount and interest rate.

- Prioritize them in order of highest interest rate to lowest.

- Identify and cut out some unnecessary expenses from your life. (Get out that budget again, sister.)

- Take the money you’ve scraped off from limiting unnecessary expenses and start putting it toward your highest-interest debt first. Keep paying the minimums on all other sources of debt. Use as many automated tools as possible in doing so (auto-payments are your friend here, too).

- Once you’ve paid off the highest-interest debt, take the money you were putting toward it and shift it to the next one. Keep paying minimums on everything else.

Keep the debt repayment train going until you no longer owe anyone shit. Once you’re debt-free (hallelujah!), you can really start to invest more for the future.

SET UP AUTOMATIC DEPOSITS TO

A HIGH-INTEREST SAVINGS ACCOUNT

(YES you can save WHILE getting out of debt. #truestory)

Just like you can set up automatic payments to service your debts, you can also set up automatic payments to service your savings. I recently opened a 2% interest earning savings account with Wealthsimple, linked it to my chequing account, and enabled it to transfer a set amount from my account every month to build up my emergency fund (I’m currently working to build up enough to cover about 3 months of expenses should shit hit the proverbial fan). Once that’s in order, I’ll divert those monthly debits to a long term (tax sheltered) investment account like a TFSA (Tax-Free Savings Account) or RRSP (Registered Retirement Savings Plan), which I’ll also establish with Wealthsimple because their fees are some of the lowest in the business. Hot Tip: If you’ve currently got these accounts set up with a bank, consider transferring them to Wealthsimple accounts instead – this will save you thousands in fees over time and ensure you’re getting the highest returns on your investments (taking your risk tolerance and time horizon into account, of course). And remember: Rebel Mamas get their first $10,000 managed for free at Wealthsimple. Just saying.

BUY LIFE INSURANCE

If you’ve got kids, life insurance is a no brainer. Think of it as buying an inheritance for your kids to cash in on (and doing so with small, manageable monthly payments). I’m relatively young with a squeaky clean medical record and I recently bought a 20-year term life insurance plan with Drop Dead Life Insurance for $24 / month. These payments give me the peace of mind of knowing that if I croak before my kids turn 26 and 24 respectively, they’ll inherit a lump sum of cash to ensure they don’t start their adult life saddled with MY fucking debt. And if I croak while they’re still little, my partner will be able to afford the small army of people he will inevitably have to hire to keep the kids alive and the household running at 100% efficiency. You can check this off your list in about 20 minutes because the Drop Dead application process is ridiculously quick and painless and happens completely online.

CREATE A WILL

Having a living will is arguably one of the most important things you can do as a parent, and although it isn’t as much fun as putting together your modern minimalist registry, it’s much more necessary. The good news is, you don’t necessarily need a lawyer to draft up a will, and these days it’s easier than ever to hop online and start the process yourself from the comfort of your home (we used Willful and the whole process happened online and took less than 30 minutes from start to finish. #bless). Why do you need a will? Because you probably want your children to be provided and cared for exactly as you wish in the (unlikely, but still possible) event that both parents should suddenly die. And if you happen to live a long and beautiful life, you will have had peace of mind when you travelled, left your children with others, and generally gone through life unscathed. If you don’t take the lead and allocate assets, finances, guardianship, and all that yourself, guess who will? The government. And do you really want them making decisions about your estate on your behalf? We didn’t think so.

*

And that’s it! An afternoon work of homework to set yourself up for a lifetime of financial freedom and a future of generational wealth.

We’ve said it before and we’ll say it again: money is the international language of power, which means that empowerment simply cannot be fully realized without financial literacy. The old adage “He who has the gold makes the rules” still holds true. The goal now is to amend the pronoun.

Next week we’ll take a closer look at generational wealth and the actions you can take now to achieve it. Financial freedom is on the horizon, ladies! Can you feel it? Let’s get that money.

*

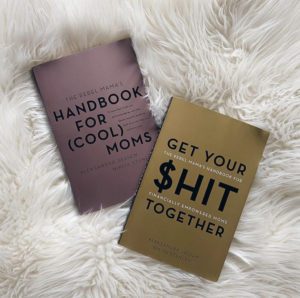

CHECK OUT OUR (BEST-SELLING) BOOKS

*

From Our Comments